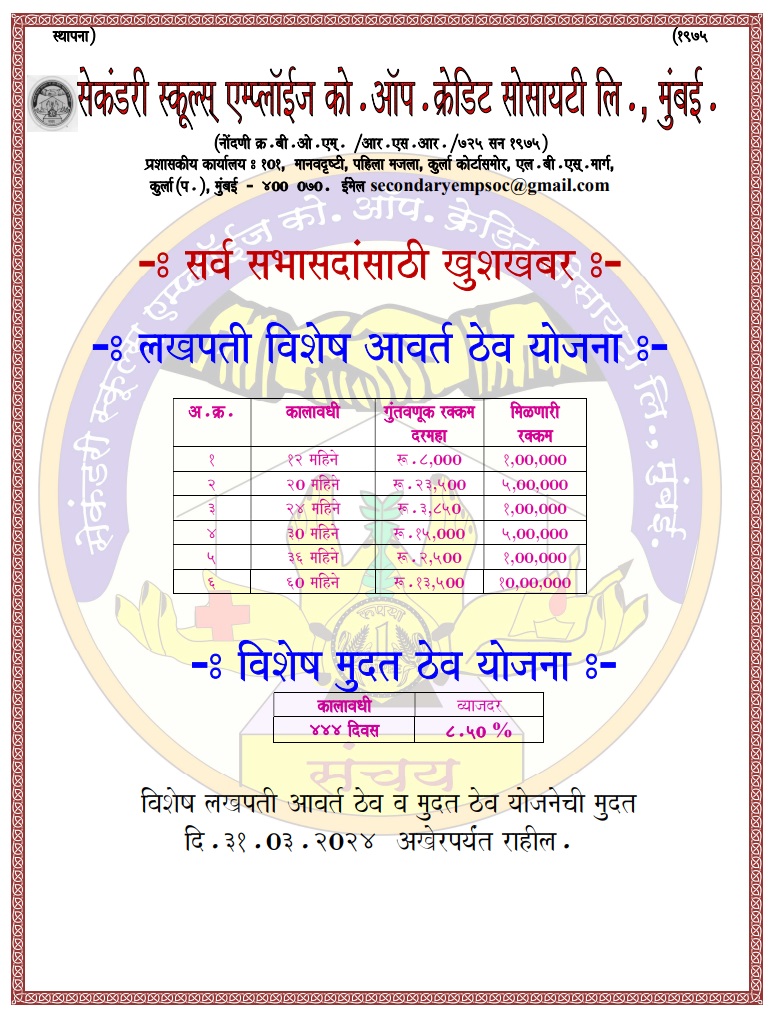

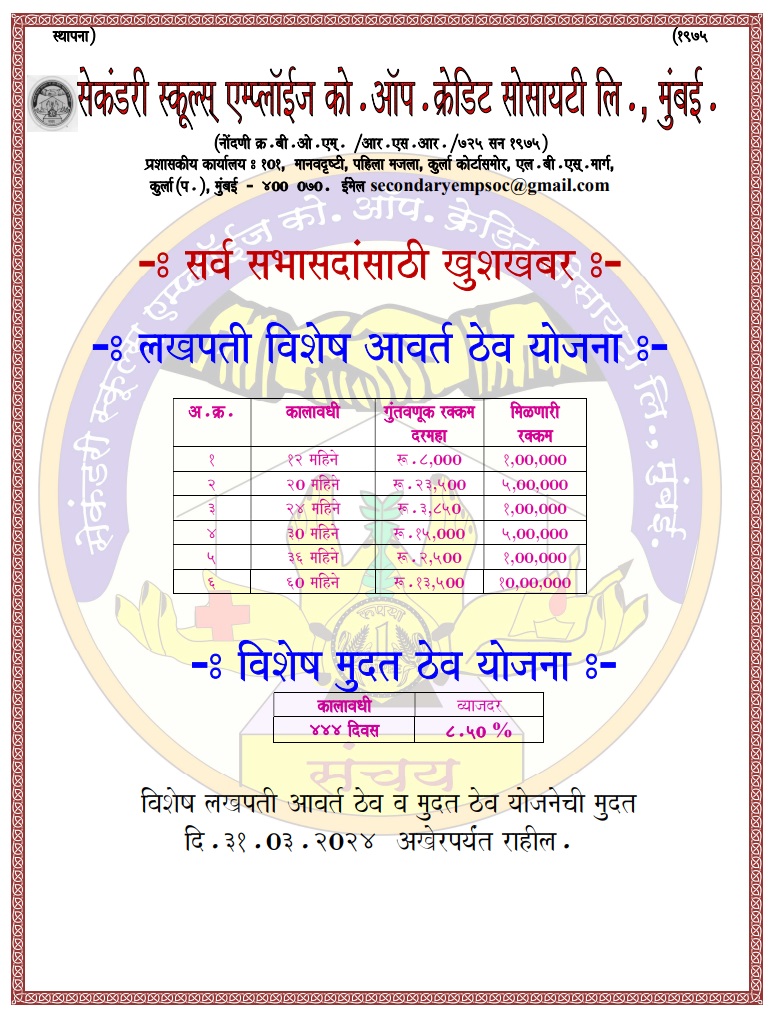

Secondary Schools Employees credit society

To become a leading co-operative credit society furnishing premium and comprehensive co-operative experience To deliver operational excellence through innovation, Technology, Quality and Commitment.

To become a leading co-operative credit society furnishing premium and comprehensive co-operative experience To deliver operational excellence through innovation, Technology, Quality and Commitment.

Term Deposits are a savings product in which you deposit a sum of money with the bank for the specific period of time. In other words, you loan money to the bank and the bank pays you the corresponding interest based on the amount and the term

Secondary society has developed a system that connects the transactions of all the branches of the organization using the core banking system. The customer of Secondary society can go to any branch of Secondary society and complete his transaction. Similarly, every transaction that takes place in any branch of Secondary society will be linked to each other and through this system all transactions can be controlled from the Head office.

Read more